Building Financial Tools That Actually Make Sense

We started saviontrela in 2019 because frankly, most fintech felt like it was designed by people who'd never actually managed money themselves.

Our team came from traditional banking and saw the same problems over and over. Clunky interfaces. Features nobody asked for. And support that vanished when you needed it most. So we built something different.

Started With a Simple Question

Why do financial tools have to be complicated? Back in 2018, our founding team was working at a mid-sized consultancy in Brisbane. Every day we watched clients struggle with systems that required three manuals and a computer science degree just to track expenses.

That year, we ran an informal survey with about 200 small business owners across Queensland. The results were eye-opening. Nearly 80% said they avoided using their financial software unless absolutely necessary. Not because they didn't care about their finances, but because the tools made simple tasks feel impossible.

Testing With Real People, Not Theories

We spent most of 2020 just talking to people. Coffee shops, co-working spaces, even a few uncomfortable folding chairs at community centers. The pandemic actually helped in a weird way because everyone was suddenly trying to manage money remotely.

One conversation I remember clearly: a cafe owner in Townsville who showed us her "system" for tracking daily sales. It involved two spreadsheets, a physical notebook, and what she called "gut feeling Thursdays." She wasn't disorganized. The tools available just didn't match how she actually worked.

Those conversations shaped everything. We realized people don't need more features. They need tools that work the way their brain already works.

Building What People Actually Need

By mid-2021, we had working prototypes. Nothing fancy, but they solved real problems. Our first proper client was a small construction company that needed to track project expenses across five sites. They'd been using a mix of paper receipts and text messages to their accountant.

Within three months, they'd cut their monthly reconciliation time from two days to about four hours. Not because we built something revolutionary, but because we paid attention to how they actually worked and built around that.

Now we work with about 340 businesses across Australia. Some are sole traders managing invoices. Others are growing companies dealing with multi-currency transactions and payroll. What they have in common: they wanted financial tools that didn't require a training manual.

What Drives Our Work

These aren't corporate buzzwords we came up with in a meeting. They're the principles that guide every decision we make, from product design to customer support.

Clear Communication

We don't hide behind jargon or fine print. If something isn't working right, we tell you. If a feature will take longer than expected, you'll know why. Transparency isn't optional for us.

Practical Solutions

Every feature we build has to solve a real problem. Not theoretical edge cases or things that might be useful someday. If we can't point to actual users who need it, we don't build it.

Continuous Learning

Financial needs change. Technology evolves. We stay curious and adapt. Our team regularly sits down with users to understand what's working and what isn't. Then we actually do something about it.

Genuine Support

When you contact us, you get a real person who knows the product. Not a chatbot. Not a script reader. Someone who can actually help solve your problem.

Sustainable Growth

We're not chasing explosive growth at the expense of quality. We'd rather grow steadily with clients who genuinely benefit from what we've built than rush to scale prematurely.

Honest Pricing

No hidden fees. No surprise charges. You pay for what you use, and we're upfront about costs from day one. If we need to adjust pricing, you'll know well in advance with a clear explanation.

The People Behind saviontrela

We're a small team of developers, designers, and financial specialists who actually enjoy making complicated things simple. Most of us came from larger companies where good ideas got lost in layers of approval processes.

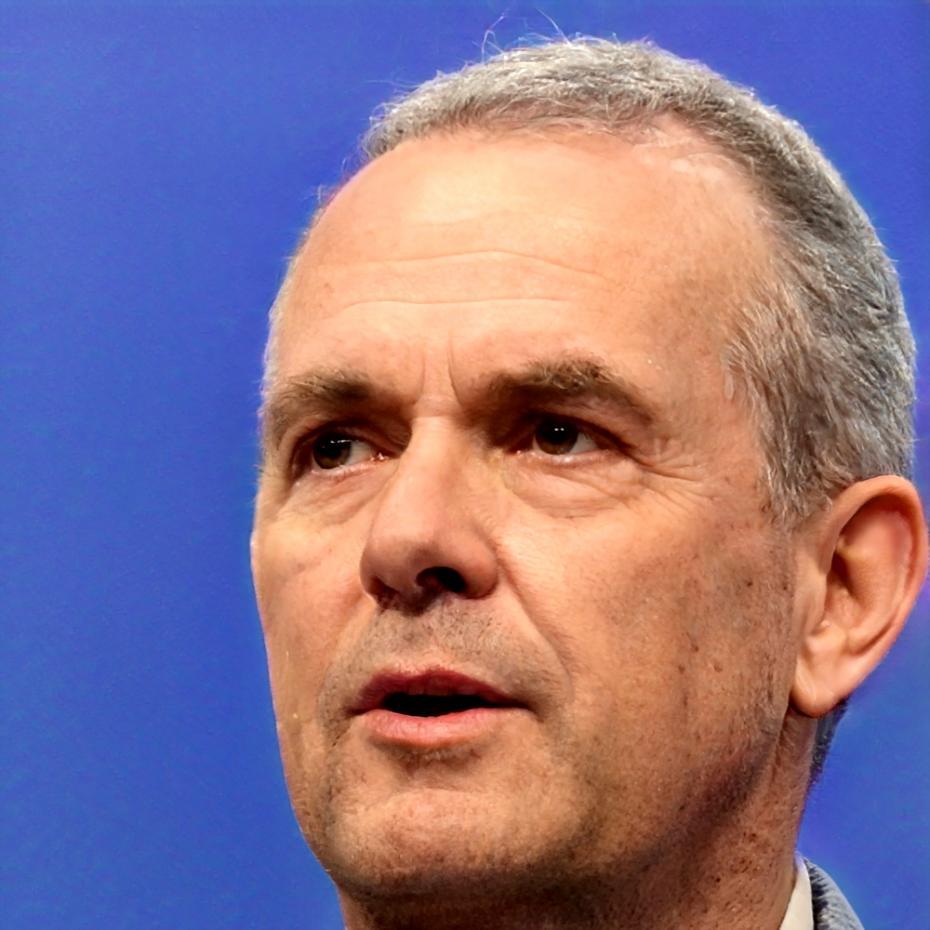

Callum Wexford

Technical Lead

Callum spent eight years at a major Australian bank before joining saviontrela in early 2020. He was the person everyone called when legacy systems needed to talk to modern infrastructure, which happened more often than anyone wanted to admit.

He left because he got tired of watching good technical solutions die in committee meetings. At saviontrela, he leads our development team and makes sure our tools actually work the way users expect them to work.

Outside of work, he's usually tinkering with vintage motorcycles or attempting to brew decent coffee with increasingly complicated equipment. His wife says both hobbies involve too many spreadsheets, which is probably fair.

Let's Talk About Your Financial Workflow

Whether you're managing a growing business or just want better control over your finances, we'd be happy to walk you through what saviontrela can do. No sales pitch, just a genuine conversation about whether we're a good fit.

Get In Touch